CA Latest News 2022 – How to become a CA, Eligibility, Fees, Exams, Best Institute

Today we will give you CA Latest News 2022 | what does CA mean | can anyone become a Chartered Accountant | how can you become a CA | what is required to become a Chartered Accountant | what does CA work | CA Final Result 2022 | CA Where and how to do the course | CPT Exam Full Syllabus | IPPC Exam Full Syllabus | CA Final Exam Full Syllabus | how much is the fee in CA | we are going to tell about the list of best institute for CA.

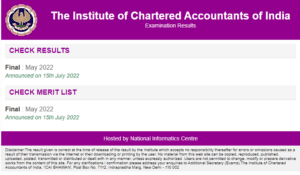

CA Final Result May 2022 Date, Time: The Institute of Chartered Accountants of India, ICAI has announced the date of CA Result 2022 through an official notice today, July 13, 2022. ICAI will release the CA Final Result 2022 for May exam either on July 15, 2022 or July 16.

CA Latest News 2022 : Institute of Chartered Accountants of India, ICAI 2022 has issued an official notice today on July 13, 2022, informing that when will the CA Result 2022 be released? The result date has been announced in the notice. ICAI will release the CA Final Result 2022 for May exam either on July 15, 2022 or July 16. That is, there is every possibility of releasing the result this week. Once the result is out, candidates will be able to check the CA final result on the official website.

The CA Result date is for CA Final May Exam 2022. These exams were conducted from May 14 to 30, 2022 along with CA Inter Exam 2022. However, the date of CA Inter Result 2022 is not yet officially announced.

Reason for the result to come on 15th July

Students please note that usually ICAI gives two dates for CA result. However, as per the past trends, usually on the given first date the CA releases the final result. Hence, the CA final result for 2022 is expected to be declared on July 15, 2022.

ICAI CCM Dheeraj Khandelwal has announced the CA final result date for May exam. On July 9, 2022, CCM announced on Twitter that the results of CA Final May Exam will be announced soon.

Result can be seen by Registration number

Students will need their Registration Number/PIN Number to check ICAI CA Final Result. They are also advised to keep a check here for the latest updates on CA Result 2022.

Let us tell you, CA Final is the final level course for the aspirants of Chartered Accountancy. Once the student clears the intermediate level examination, he/she enters the final stage of CA, that is, the CA final course, the result of which will be out soon.

What does CA mean?

CA This is a professional course that includes work related to accounts, finance, tax, money management, planning etc. Along with this, planning of business growth, budget auditing also comes under CA.

CA is the best course for those who are interested in account, because if you work hard once in it and get the post then you will be very lucky. It is a great honor to get the post of CA.

Can anyone become a Chartered Accountant?

Many students and people have this question whether they can become a Chartered Accountant or not, because they have taken any other stream, then for them, let us tell you that you have taken any stream, whether it is Arts, Science, Commerce. , Medical or any other stream. ,

How can you become a CA?

As I said if you are interested in account subject and want to see yourself becoming a Chartered Accountant, but you are not aware of it, then do not panic, we are going to share the process.

What is required to become a Chartered Accountant?

To become a CA, you have to clear the entrance exam. Now let’s talk about it in details

- You can apply for the entrance exam only after class 10th, but keep in mind that you have to give this exam only after passing 12th and not before that.

- To become a CA, it is compulsory for you to be 12th pass.

- It doesn’t matter what percentage you have got in your 12th. You just need to have 12th pass then you can be eligible to appear for the entrance exam.

What does CA do?

CA is a financial advisor and a financial planner who looks after all the work related to tax and managing accounts, managing budget, conducting tax audit etc. Chartered Accountant is a very big post like that of an engineer or a doctor.

Where and how to do CA course?

You can apply for CA course by visiting the official website (ICAI) The Institute of Chartered Accountants of India. Only after that you have to apply for foundation course.

To become a CA, you have to go through three types of examinations, if you pass these three examinations with good marks, then now you are ready to become a CA. Let us know what are those three exams and how much are their fees:

1. CPT Exam

The full form of CPT is Common Proficiency Test, you can start preparing for this exam only after 10th. But the exam has to be given only after 12th.

CPT Exam Full Syllabus

- Fundamentals of Accounting (60 Marks)

- Mercantile Law (40 Marks)

- General Economics (50 Marks)

- Quantitative Aptitude (50 Marks)

Registration Fee – Rs. 9,000

2. IPPC Exam

The full form of IPPC is Integrated Professional Competency. If the student has more than 50% percentile in graduation, then he/she becomes eligible to do PPS without CPT exam.

IPPC Exam Full Syllabus :

- Accounting

- Business Laws, Ethics and Communication

- Cost Accounting and Financial Management

- Taxation

- Advanced Accounting

- Auditing and Assurance

- Information Technology and Strategic Management

Registration Fee – Rs.15,000

3. CA Final Exam

After clearing two exams, now it is the turn of Apprentice Training, which is 3 years old, then 6 months before that you can apply for the final exam, if it is passed in the last exam, then ICAI chooses a member for it. Is.

CA Final Exam Full Syllabus

- Financial Reporting.

- Strategic Financial Management.

- Advanced Auditing and Professional Ethics.

- Corporate and Economic Laws.

- Strategic Cost Management and Performance Evaluation.

- Risk Management.

- Financial Services and Capital Markets.

Registration Fee – Rs. 22,000

How much is the fee in CA?

By the way, we cannot tell hundred percent exactly how much fee is required to do this CA because different colleges charge different fees.

But according to an estimate and data, CA costs 2 lakh to 4 lakh. In which all three types of exams are included which you have just read above.

In which department can work after becoming a CA?

- Finance Companies

- Private and Public Sector Banks

- Pvt Limited Companies

- Patent Firms

- Legal Firms

- Auditing Firms

- Investment Houses

- Stockbroking Management

- Portfolio Management Companies

List of best Institute for CA

| Institute Name | Address |

| D.N.S. College of Engineering and Technology | Amroha in Uttar Pradesh |

| Exalt College of Engineering and Technology | Vaishali in Bihar |

| ETEN CA | Bengaluru in Karnataka |

| ETEN Finance | Noida in Uttar Pradesh |

| Mohamed Sathak Engineering College is situated | Ramanathapuram in Tamil Nadu |

| Central College of I.T | Raipur in Chhattisgarh |

| Gokaran Narvadeshwar Institute Of Technology & Management | Lucknow in Uttar Pradesh |

| College of Science & Engineering | Jhansi in Uttar Pradesh |

| MSR Degree College | Kavali in Andhra Pradesh |

| Pannaikadu Veerammal Paramasivam College | Dindigul in Tamil Nadu |

| Sree Pashmi Institute of Management and Science | Coimbatore in Tamil Nadu |

| Modern Academy | Vijayawada in Andhra Pradesh |

Frequently Asked Questions

Q1. How long does it take to become a CA?

Ans: It takes 5 years to become a CA, the exam is divided into three parts: CA Foundation, Intermediate, Articleship and CA Final. If the student is very smart and studies diligently, then he can become a CA in 4 years.

Q2. Which subjects are included in CA?

Ans: If after 10th you take commerce stream in 11th and 12th then it is very good, because the subjects involved in it help you a lot in CA Accounting, Audit, Management accounting, Corporate law, Business economics, Capital market, Logical reasoning , Business Mathematics etc. subjects are included.

Q3. What is the salary of CA in India?

Ans: After becoming a CA, the salary is kept according to the post and may be slightly different everywhere:

- Accounts Clerk Rs. 2,50,000

- Taxation/Internal Rs.3,50,000

- Advisory Forensic Rs.3,00,000

- Auditing CEO (Chief Executive) Rs.5,00,000

- CFO (Chief Finance Officer) Rs.5,00,000

Also Read : Why to become a Chartered Accountant